income tax submission malaysia

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Only residents or citizens are taxed on worldwide income.

Tax Filing Deadline 2022 Malaysia

Tax payable under an assessment upon submission of a tax return is due and payable by the last day of the seventh month from the date of closing of accounts.

. Malaysias income tax system is territorial in nature. Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income. Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year Personal Tax Relief 2021.

The tax estimation submission in Malaysia under Section 107C of the Malaysian Income Tax Act 1967. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. Once you know your income tax number you can pay your taxes online.

In such instances tax residents will be exempted from paying personal income tax in Malaysia. Schedule On Submission Of Return Forms RF Contoh Format Baucar Dividen. And part B2 in the BE form or part B7 in the B.

You can do so under the Statutory income from rents when making an online submission. See the tax regime for neo-domiciled individuals in the Taxes on personal income section which substitutes the income tax on foreign rental. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

Form P Income tax return for partnership Deadline. 45012485 from which tax has not been deducted on time due to the semantics of section 80AB rw section 29. PAYE became a Final Withholding Tax on 1st January 2013.

Following the announcement made by MOF on 30 December 2021 the following Exemption Orders have been gazetted on 19 July 2022. By using the prescribed form CP204. The income tax appellate authority Mumbai pointed out the profits of the housing development are to be calculated at Rs82690888 after putting it under the purview of section 40aii and disallowing payments totalling Rs.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8. SST Penalties and Offences in Malaysia. The system is thus based on the taxpayers ability to pay.

SST Return Submission and Payment. The companyLLP must have a paid-up capital of ordinary sharescapital contribution not exceeding RM25 million at the beginning of the basis period for the year of assessment the tax rebate claim is made. This is because the correct amount.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Company Tax Deduction 2021. This means that a company whether resident or nonresident is assessable on its income sourced from within Malaysia.

Return Form RF Filing Programme. The SME company means company incorporated in Malaysia with a paid up capital of. Introduction Individual Income Tax.

The DAC List of ODA Recipients shows all countries and territories eligible to receive official development assistance ODA. As a result most employees will not be required to lodge Form S returns. Malaysia Personal Income Tax Rate.

30042022 15052022 for e-filing 5. The IRB is fully in their right to fine 100 of the undercharged tax. Data and research on tax treaties including OECD Model Tax Convention Mutual Agreement Procedure Statistics prevention of treaty abuse The multilateral instrument MLI will implement a series of tax treaty measures to update international tax rules and lessen the opportunity for tax avoidance by multinational enterprises.

Whereas the category of non-residents individuals companies etc still remain eligible for income tax exemption. Here are the common taxes in Malaysia. The recommended form of the first submission is Form CP204 and revising the Form CP204A initial submission.

A second signing ceremony took place at the OECD on. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. Income Tax Exemption No.

For manual submission of monthly tax deductions of unregistered users and for one time submissions only. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Rental Income Tax Malaysia And Other Tax Reliefs For YA 2021.

5 Order 2022 Exemption of FSI received by resident individuals. Meanwhile an income of a resident company derived from outside the country is exempt from tax. Goods and Person Exempted from Sales Tax.

SST Registration in Malaysia. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

9 Order 2017 PUA 323 was gazetted on 24 October 2017. These consist of all low and middle income countries based on gross national income GNI per capita as published by the World Bank with the exception of G8 members EU members and countries with a firm date for entry into the EU. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property.

Special Income Remittance Program PKPP For Malaysian Tax Resident With Foreign Sourced Income. If the income tax submission is filed late it may. 30062022 15072022 for e-filing 6.

Expatriates may benefit from a special tax regime exemption on their income if the following two conditions are verified. This Order exempts a person not resident in Malaysia from income tax payment in respect of income falling under Section 4Ai and. We recommend submitting PCB via e-Data PCB as it is the most convenient option of the three.

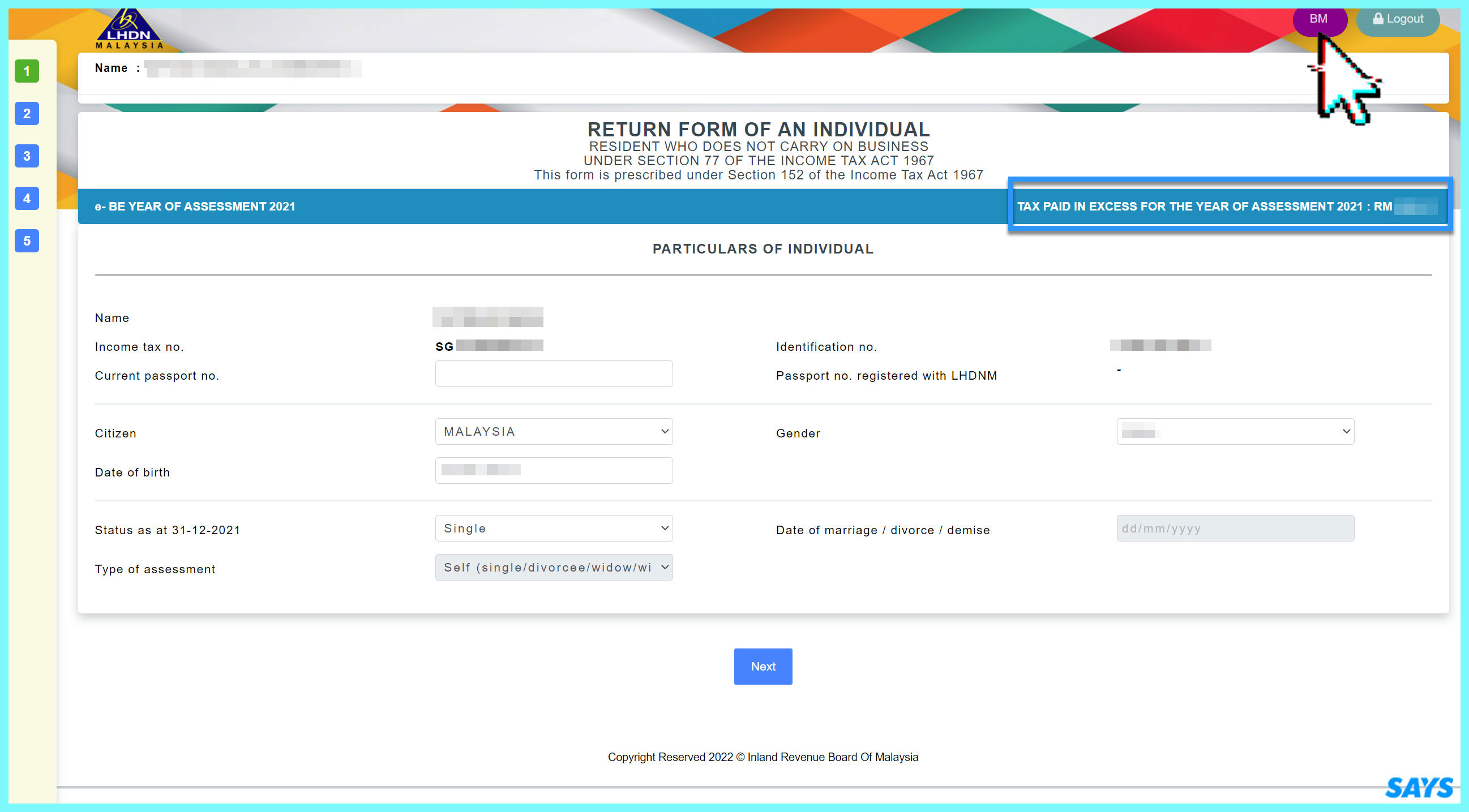

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. Otherwise if the income deriving from rented real estate owned outside of Italy is not subject to taxation in the foreign country the rental income reduced by 15 constitutes the taxable income in Italy. Companies are required to furnish estimates of their tax payable for a year of assessment no later than 30 days before the beginning of the basis period normally the financial year.

Introduction to Monthly Tax Deduction MTDPCB - Part 1 of 3 10th Aug 2022. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. By PropertyGuru Editorial Team.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. What is the Proper Way to Submit the Tax Payable Estimation. Form B Income tax return for individual with business income income other than employment income Deadline.

Income tax return for individual who only received employment income Deadline. The companyLLP must be incorporated or registered in Malaysia and is a tax resident for tax purposes. Graduated rates from 5 to 32 apply to citizens resident aliens and non-resident aliens staying in the country for more than 180 days in a year.

Income Tax payment. CP204 Due Date of the Submission. Foreign nationals and non-residents are subject to income tax only on income from Philippine sources.

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

How To File Income Tax For The First Time

Yc Accounting And Personal Tax Services Want To Know More About Personal Income Tax In Malaysia Fresh Grad With Your First Job Working Adult But Still Doesn T Know How Income

Watch This Before Filing Income Tax 2022 Pt 1 Complete Guide To File Tax Returns In Malaysia Youtube

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

I Filed My First Income Tax Tutorial For Beginner Tax Payers In Malaysia Youtube

Personal Income Tax Archives Tech Arp

How To File Income Tax For The First Time

Malaysia Personal Income Tax Guide 2021 Ya 2020

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

How To File Income Tax For The First Time

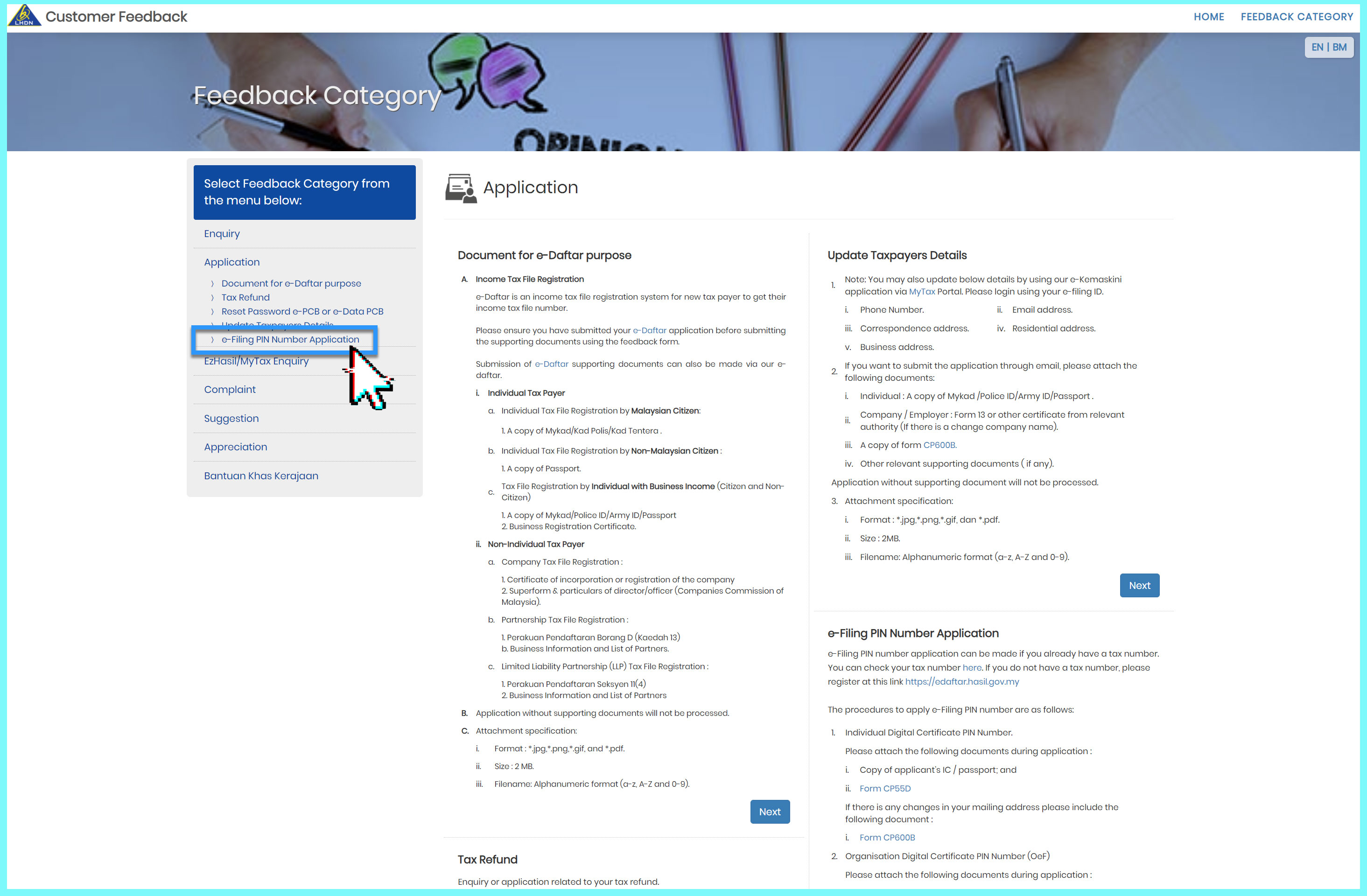

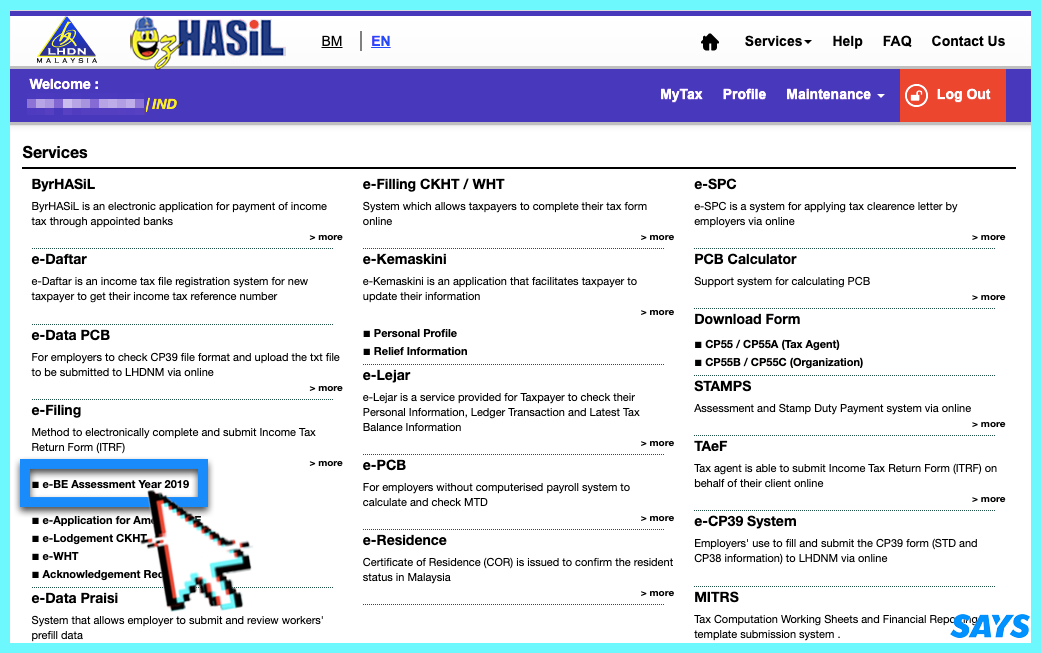

Guide To Using Lhdn E Filing To File Your Income Tax

Oveetha Management Services Income Tax Submission Is Due Very Soon If You Need To Do E Filing For Business Enterprise Income Tax Form B It Can Approach Me For Below

Guide To Using Lhdn E Filing To File Your Income Tax

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Income Tax Breaks For 2020 The Star

0 Response to "income tax submission malaysia"

Post a Comment